Customer Lifetime Value – What’s Yours?

If you’re in business, you know that customers are the lifeblood of your company. But do you know how to measure their worth? Do you know what their customer lifetime value is? You should! Knowing your customer lifetime value is critical for understanding whether or not your marketing and sales efforts are paying off. Let’s look at why it’s so important to understand this metric and how to calculate it.

What Is Customer Lifetime Value?

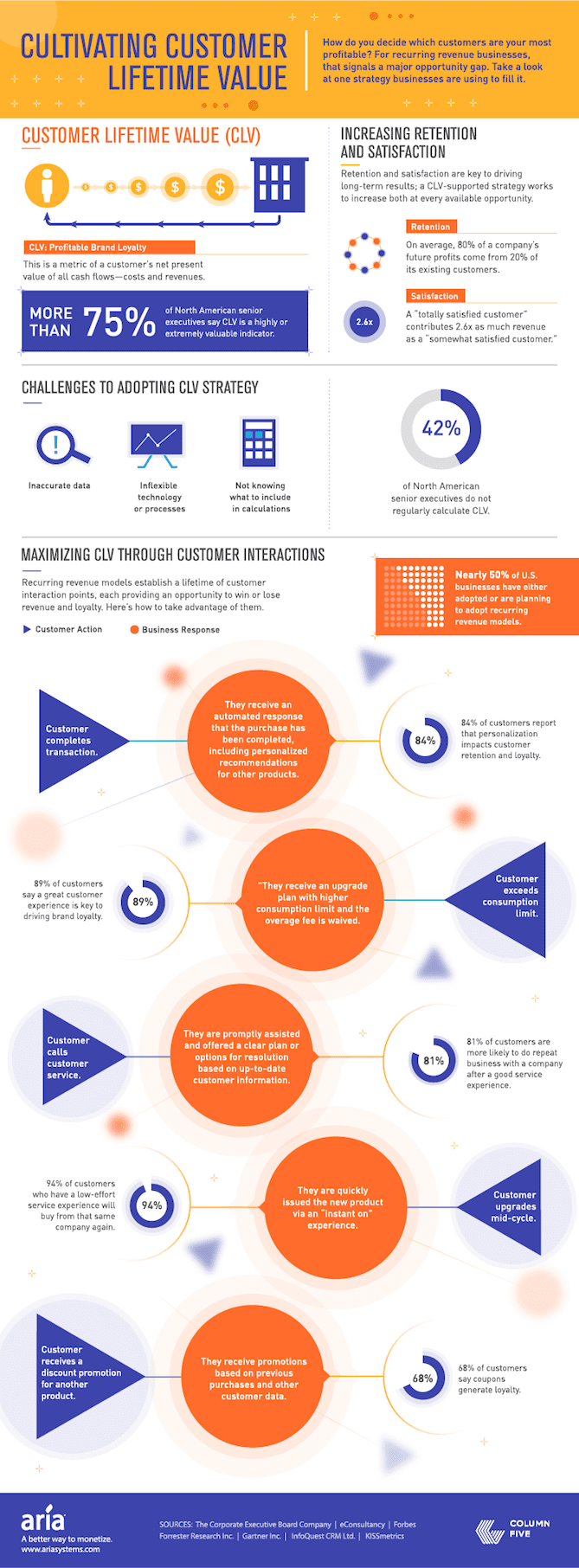

Customer lifetime value (CLV) is a metric that measures the financial worth of a customer over the course of their entire relationship with a company. It’s calculated by taking into account factors such as purchase frequency, average purchase price, and estimated customer lifespan. By understanding CLV, businesses can identify which customers are most valuable and tailor their services accordingly.

How to Calculate CLV

Calculating Customer Lifetime Value (CLV) isn’t an exact science – there are many variables that need to be taken into account when determining an individual customer’s financial worth. However, there are some basic steps you can take to get a good estimate of your overall CLV:

- Estimate future revenue: Start by estimating the amount of revenue each customer is likely to generate in the future (over the course of their “lifetime”). This includes taking into account any upsell opportunities, loyalty programs, etc.

- Calculate cost per acquisition: Next, calculate the cost per acquisition (CPA) for each customer – i.e., how much does it cost you to acquire a new customer? This figure should include things like marketing expenses as well as any costs associated with servicing existing customers (such as support staff).

- Calculate retention rate: Finally, calculate your retention rate – i.e., how many customers do you keep over time? This rate will vary depending on the type of business you’re in; for example, subscription-based companies tend to have higher retention rates than one-off retailers or service providers.

Image credit: Hubspot

Knowing your Numbers is Important

Knowing your customer lifetime value is essential if you want to maximise profits and ensure long-term success for your business. By calculating this number accurately, you can identify which customers are most valuable and focus on developing content for lead generation. Not only, can you then attract that ideal customer throughout their buyer’s journey. And then strategies that retain them over time. So don’t wait – start calculating your own Customer Lifetime Value today!